When looking back to the beginning of the year mortgage rates were projected to gradually increase and eventually end up in the 3% range toward the end of the year. Well as you can see, we are approaching the end of April quickly and are already well into the 4% range. In fact, in the first 3 months of the year rates have jumped 1.5 percentage points. It’s the biggest quarterly climb in 28 years!! As of April 14th, 2022, mortgage rates have jumped to the 5% range. That’s the highest level in 11 years.

What will this do to the housing market you ask? Ali Wolf, Chief Economist at Zonda explains: “Mortgage rates jumped much quicker and much higher than even the most aggressive forecasts called for at the end of last year, and yet housing demand appears to be holding steady.”

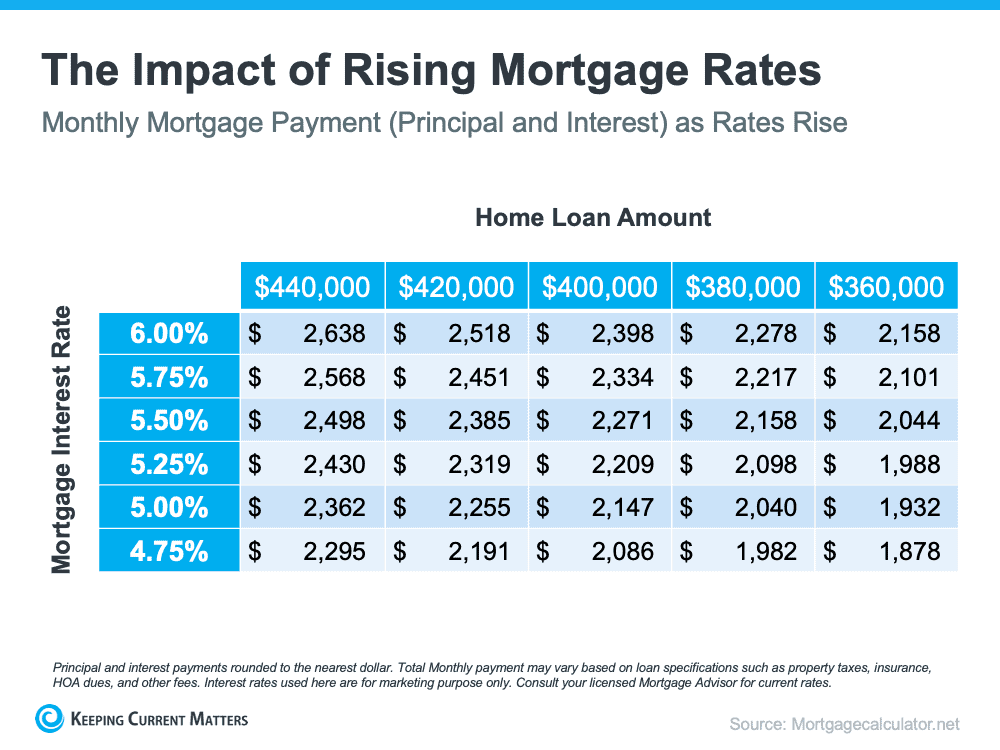

Even though you have had thoughts of postponing your home search, putting your plans on hold will only cost you more in the long run. Rising mortgage rates will only lessen your purchasing power. Meaning that when mortgage rates increase so does your monthly payment. This will affect how much you can spend on your new home.

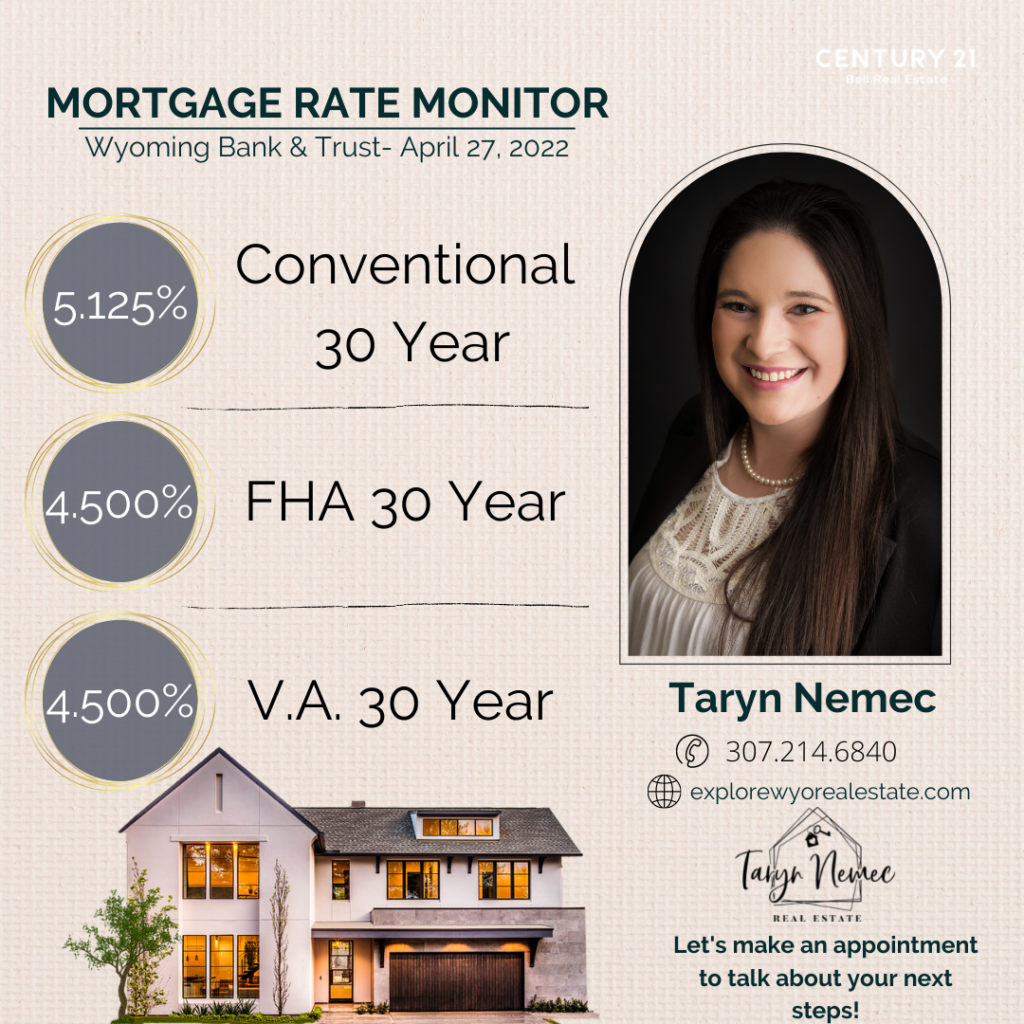

Here is an example of what the mortgage rate increase may look like and affects it will have on your monthly mortgage payments.

With mortgage rates on a steady incline, rather than deterring you from making a purchase, it should encourage you to get moving.

Let’s get to work on finding you your new home before rates climb even higher! Fill out the form below to get started on your buying journey or call or text me any time! Taryn Nemec: 307.214.6840!

Leave a Reply